Here are some of the key learnings:

Energy Is a Primary Need for Performance Products

Energy is a top need for performance consumers. 73% of global consumers use products before a workout to supply them with sustained energy, while 68% use them for energy boosts, according to FMCG Gurus.1 In the sports performance category, energy includes both physical and mental aspects.

Since energy is about priming or stimulating action, it begins with the brain. However, energy is ultimately aimed toward better physical performance—e.g., faster, higher, or stronger.

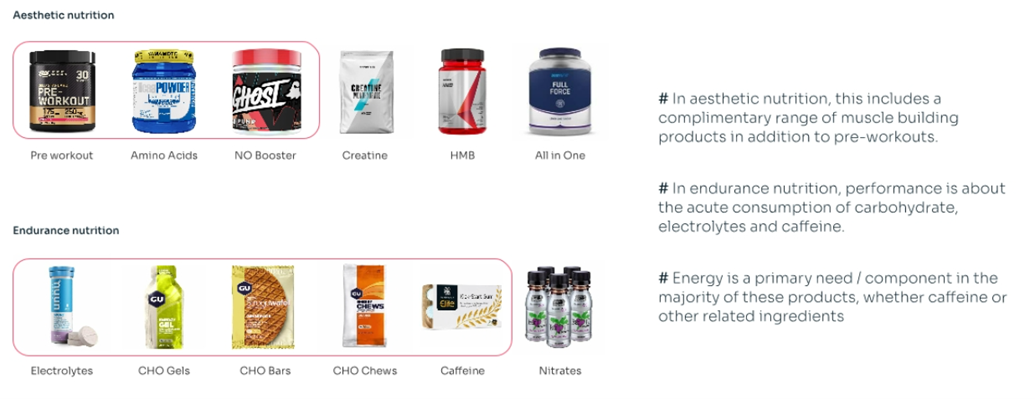

In endurance nutrition, energy is a need in electrolyte, gel, chew, and bar products, while in aesthetic nutrition (i.e., for muscle building), it shows up in pre-workout, amino acid, and nitric oxide booster products. Energy can be seen as a gateway into the category of performance nutrition.