These gummy offerings align fairly well with consumer demand because, besides multivitamins, male supplement users overall are most likely to be taking vitamin C (or vitamin D for those aged 35-75), while female users are most likely to be taking vitamin D (or vitamin B12 for those aged 18-34).8

Opportunities exist, however, in gummy options for calcium and probiotics (supplements commonly used by both men and women)9 and for brain/cognitive health, children’s health, menopause, and mood/mental health, which are the currently the fastest-growing condition-specific supplements in the US.10

Consumers’ interest in health-supporting supplements has also been growing. More than one in three US supplement users are relatively new users, having started taking a supplement within the past two years,11 and taking multiple supplements is typical across gender and age groups.12

Technological Advancements: TechVantage®

Innovation in supplement delivery formats has been largely made possible through new ingredient technologies. In gummy supplements, for example, ensuring nutrient stability presents different challenges compared to pill formats. Shifting from a dry blending operation to a high temperature, low pH, liquid process can degrade nutrients unless specific measures are taken.

The TechVantage® Advantage

TechVantage functionally optimized nutrient technologies, which range from microencapsulations to granulations to triturations, depending on formulation and process needs, can be used to expand supplement format possibilities. These technologies protect sensitive nutrients from losses through degradation and ingredient interactions, ensuring nutrient targets are met after processing and at the end of the product’s shelf life.

The additional TechVantage benefits of taste and odor masking are especially valuable when a supplement contains bitter or metallic-tasting ingredients such as certain botanicals, vitamins, or minerals. TechVantage solutions can also optimize for color, clarity, and dispersibility (which benefits drink mixes and supplement shots, for example), and homogeneity for consistency throughout a batch.

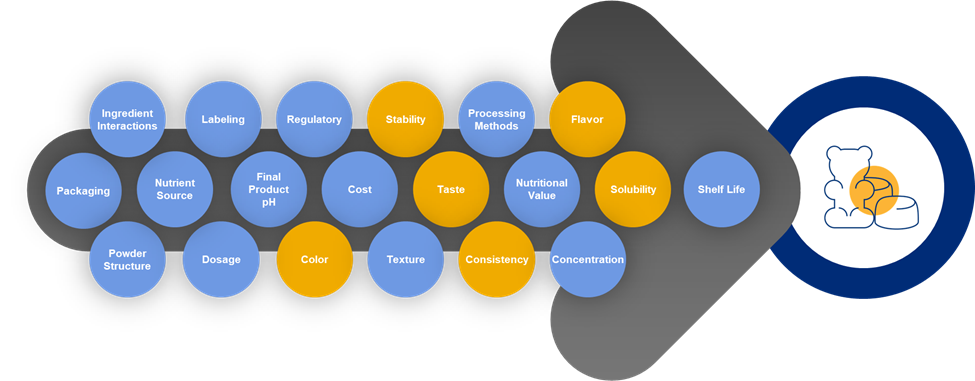

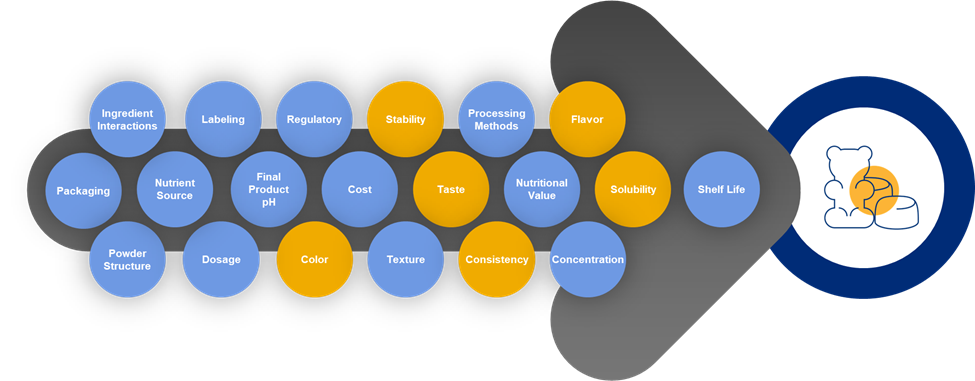

When formulating a custom premix our R&D scienticts consider a comprehensive list of product attributes. Our functionally optimized nutrients support many of these attributes.

Benefits of Gummy Supplements and Innovative Formats

Consumers may be attracted to alternative supplement delivery formats for their palatability and convenience, but there are many other benefits. The great taste and flavor variety can improve compliance as they act as a treat or reward for taking care of oneself. For kids, taste plus the visual appeal of fun colors and shapes (for gummies, for example) can get them excited about taking their daily vitamin and help them develop this healthy habit.

Advantages of Gummy over Pill Formats

- Great taste

- Flavor variety

- Colors and shapes that appeal to kids

- Can improve compliance

- On-the-go option that does not require water

- Easier to swallow

- Gentle on the stomach

- More bioavailable for fat-soluble vitamins

Bars/bites, gels, gummies, soft candies, and shots all provide on-the-go convenience, because they don’t require water to consume, and can be consumed anywhere and anytime. Supplement formats that function like foods or beverages can also be easier to swallow, gentler on the stomach, and more bioavailable for fat-soluble vitamins (like vitamins D, E, and K) if the formulation contains any oils or fats.

Outlook on Alternative Supplement Delivery Formats

With the number of supplement users growing, the high prevalence of multiple supplement usage, and the tremendous popularity of the gummy format among younger consumers, brands can expect an even greater demand for enjoyable and interesting supplement formats going forward.

Further innovation in supplement delivery may include an expansion into more adventurous flavors, from exotic fruits to cocktails to sweet and savory combinations, as well as new textures (for edible formats) and unique packaging (for ready-to-drink formats).

Consumers will be looking beyond vitamins and minerals to supplements for mood, sleep, and women’s health—especially those that can be used on demand, as needed—as a complement to their daily vitamin and mineral supplements. More parents will seek extra support for their kids’ health such as a children’s multi with natural functional ingredients for brain or immune support.

Innovate with Us

Brands that stay ahead of market trends and technology advancements in the supplement industry will be ready with the innovative supplement formats they need to meet consumer demand and maintain a competitive edge.

How might you innovate in your product lines or processes to adapt to these market trends? Our consumer insights, technical expertise, and ingredient solutions—from flavors to custom premix solutions to TechVantage® functionally optimized ingredients—can get you there.

Contact Glanbia Nutritionals to explore more insights and partnership opportunities in innovation.